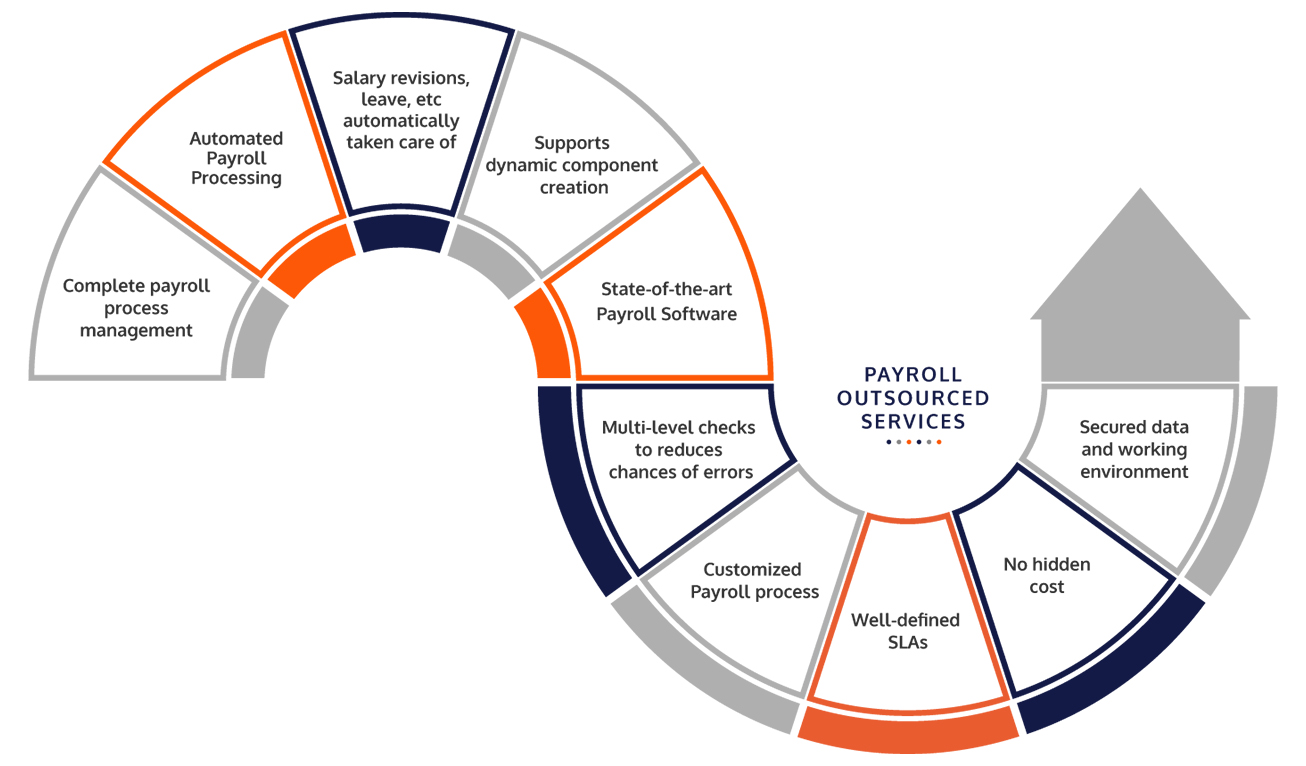

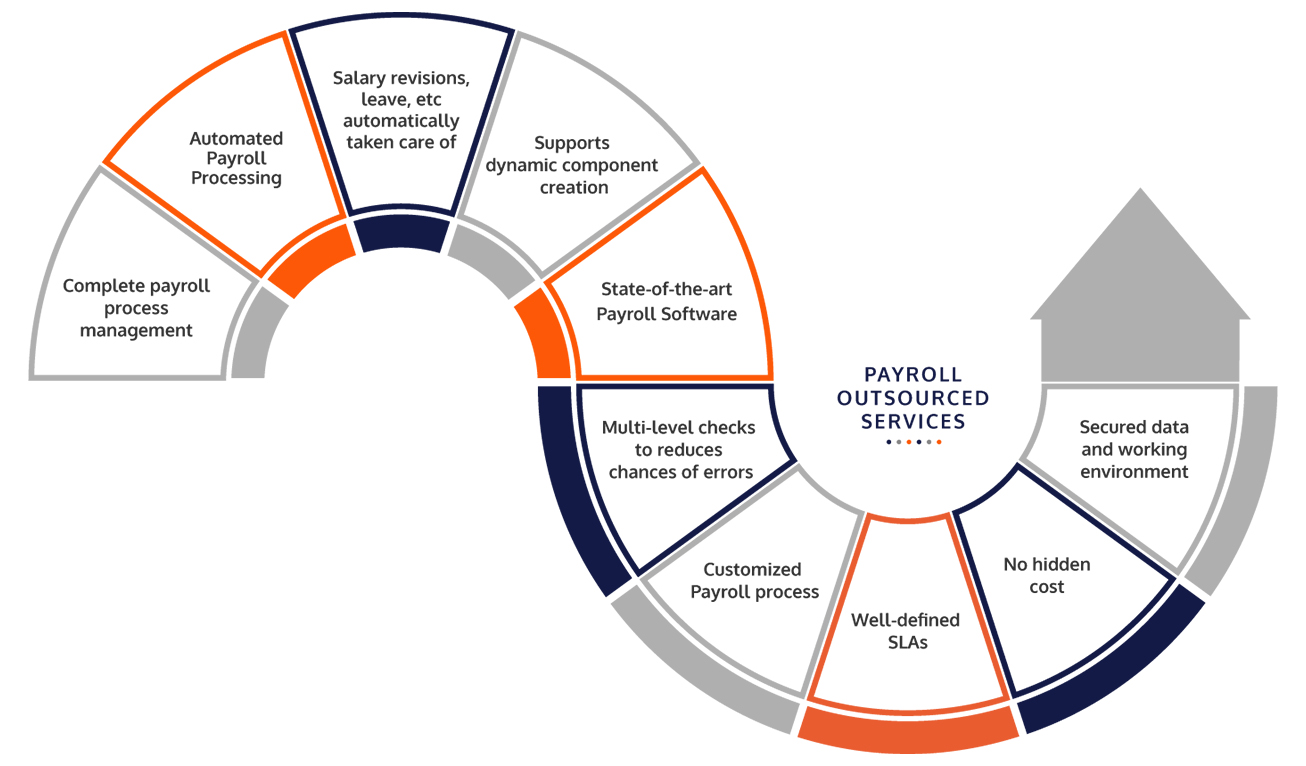

Payroll Outsourcing Services

We, SWAYAM BUSINESS SOLUTIONS PVT.LTD. simplify your payroll operations with group payroll solutions. We ensure that your employees are paid accurately without any mistakes,taking care of payroll administrative tasks.

Managing payroll can be a complex and time-consuming task for any organization. From calculating wages and deductions to ensuring compliance with tax regulations, payroll processing requires expertise and precision. As businesses strive to focus on core operations and drive growth, many are turning to payroll and salary outsourcing services to streamline their processes and improve efficiency.

What is Payroll and Salary Outsourcing?

Payroll and salary outsourcing involves delegating payroll management tasks to a specialized third-party service provider. These service providers offer comprehensive solutions that handle payroll processing, tax compliance, employee benefits administration, and more. By outsourcing these functions, businesses can reduce the burden on their internal resources and gain access to expert knowledge and technology.

The Benefits of Payroll and Salary Outsourcing

1. Cost Savings

Outsourcing payroll can result in significant cost savings for businesses. By eliminating the need to hire and train in-house payroll staff, organizations can reduce labor costs. Additionally, outsourcing eliminates the need to invest in payroll software and infrastructure, as the service provider takes care of these resources.

2. Time Efficiency

Payroll processing is a time-intensive task that requires meticulous attention to detail. By outsourcing this function, businesses can free up valuable time for their HR and finance teams. This allows them to focus on strategic initiatives and core business activities, ultimately improving productivity and efficiency.

3. Accuracy and Compliance

Payroll outsourcing providers are experts in managing complex payroll processes and staying up to date with ever-changing tax and labor laws. By leveraging their knowledge and experience, businesses can minimize the risk of errors and ensure compliance with all relevant regulations. This reduces the likelihood of penalties, audits, and legal issues.

4. Scalability and Flexibility

As businesses grow and evolve, their payroll requirements change. Outsourcing payroll provides the flexibility to scale payroll services up or down based on business needs. Whether it's onboarding new employees, managing seasonal fluctuations, or expanding into new markets, outsourcing allows for seamless payroll management without disruptions.

5. Enhanced Data Security

Data security is a critical concern for payroll management. Payroll outsourcing providers invest in robust security measures to protect sensitive employee data. They employ encryption protocols, secure servers, and regular data backups to ensure data integrity and confidentiality. This helps businesses mitigate the risk of data breaches and unauthorized access.

Key Features of Payroll and Salary Outsourcing Services

1. Payroll Processing

Payroll processing is the core function of outsourcing services. Service providers handle tasks such as calculating wages, processing deductions, generating pay stubs, and managing direct deposits. They also handle any changes to employee payroll, such as salary adjustments, bonuses, or overtime pay.

2. Tax Compliance

Staying compliant with tax regulations is crucial for any business. Payroll outsourcing providers have a deep understanding of tax laws and keep abreast of changes to ensure accurate and timely tax filings. They manage payroll tax deductions, prepare and file tax returns, and generate employee tax documents such as W-2 and 1099 forms.

3. Employee Self-Service Portals

Modern payroll outsourcing services offer employee self-service portals that enable employees to access their payroll information conveniently. Employees can view and download pay stubs, access tax documents, update personal information, and submit time-off requests. These portals empower employees and reduce administrative burdens for HR departments.

4. Reporting and Analytics

Payroll outsourcing providers offer comprehensive reporting and analytics capabilities. Businesses can gain insights into payroll costs, labor trends, and other key metrics through customizable reports and dashboards. These analytics help organizations make data-driven decisions, identify cost-saving opportunities, and improve workforce management strategies.

5. HR Integration

Integration with other HR systems is an essential feature of payroll outsourcing services. Seamless integration allows for the exchange of data between payroll and HR systems, ensuring accurate employee records and streamlined processes. Integration eliminates manual data entry, reduces errors, and enhances overall HR efficiency.

Choosing the Right Payroll Outsourcing Provider Swayam Business Solutions

1. Assess Your Needs

Before selecting a payroll outsourcing provider, assess your organization's specific needs and goals. Determine the scope of services required, the size of your workforce, and any industry-specific requirements. Understanding your needs will help you identify providers that can meet your unique payroll requirements.

2. Expertise and Experience

Look for payroll outsourcing providers with a proven track record and extensive experience in handling payroll for businesses similar to yours. Consider their expertise in tax compliance, familiarity with local regulations, and ability to adapt to changing payroll requirements. Client testimonials and case studies can provide insights into their service quality.

3. Data Security Measures

Payroll data is highly sensitive, so it's crucial to evaluate the security measures implemented by the provider. Inquire about their data encryption protocols, access controls, and disaster recovery plans. Assess their compliance with industry standards such as the General Data Protection Regulation (GDPR) and Payment Card Industry Data Security Standard (PCI DSS).

4. Technology and Software

Payroll outsourcing providers should have advanced payroll software and technology infrastructure to deliver efficient and accurate services. Inquire about the software they use, its features, and its ability to integrate with your existing systems. Additionally, check if the provider offers mobile accessibility and user-friendly interfaces for enhanced user experience.

5. Service Level Agreements (SLAs)

Service Level Agreements (SLAs) outline the terms and expectations of the service provided by outsourcing vendors. Review SLAs carefully to understand service guarantees, response times, issue resolution protocols, and penalties for non-compliance. Clear and well-defined SLAs ensure transparency and accountability between your organization and the service provider.

Considerations for a Successful Payroll Outsourcing Transition

1. Communication and Collaboration

Open and effective communication is crucial throughout the payroll outsourcing transition. Establish clear lines of communication, designate key points of contact, and ensure regular updates and meetings to address concerns and resolve issues promptly. Collaboration between internal stakeholders and the outsourcing provider is vital for a smooth transition.

2. Data Migration and Integration

A successful transition requires the seamless migration of data from your internal systems to the payroll outsourcing provider's platform. Work closely with the provider to ensure accurate data transfer, validate information, and test the integration between systems to avoid any disruptions or data discrepancies.

3. Change Management

Implementing payroll outsourcing often involves organizational changes. Develop a change management plan to address potential resistance or concerns from employees. Communicate the benefits of outsourcing, provide training and support for employees using new self-service portals, and foster a culture of acceptance and adaptability.

4. Training and Support

Ensure that your employees receive adequate training and support to navigate the new payroll system effectively. The outsourcing provider should offer comprehensive training materials, user guides, and access to a support team to address any questions or issues that may arise during the transition and beyond.

5. Continuous Evaluation and Feedback

Regularly evaluate the performance of the payroll outsourcing provider to ensure they meet your expectations and service level agreements. Provide feedback on areas for improvement and collaborate with the provider to optimize processes and enhance service delivery. Continuous evaluation and feedback foster a strong partnership and drive ongoing improvement.

Outsourcing payroll and salary services can bring numerous benefits to businesses, including cost savings, time efficiency, accuracy, scalability, and enhanced data security. By partnering with a reputable payroll outsourcing provider and following best practices for a successful transition, organizations can streamline their payroll processes, reduce administrative burdens, and focus on strategic initiatives for long-term success. Embrace the power of payroll outsourcing and take your business to new heights.